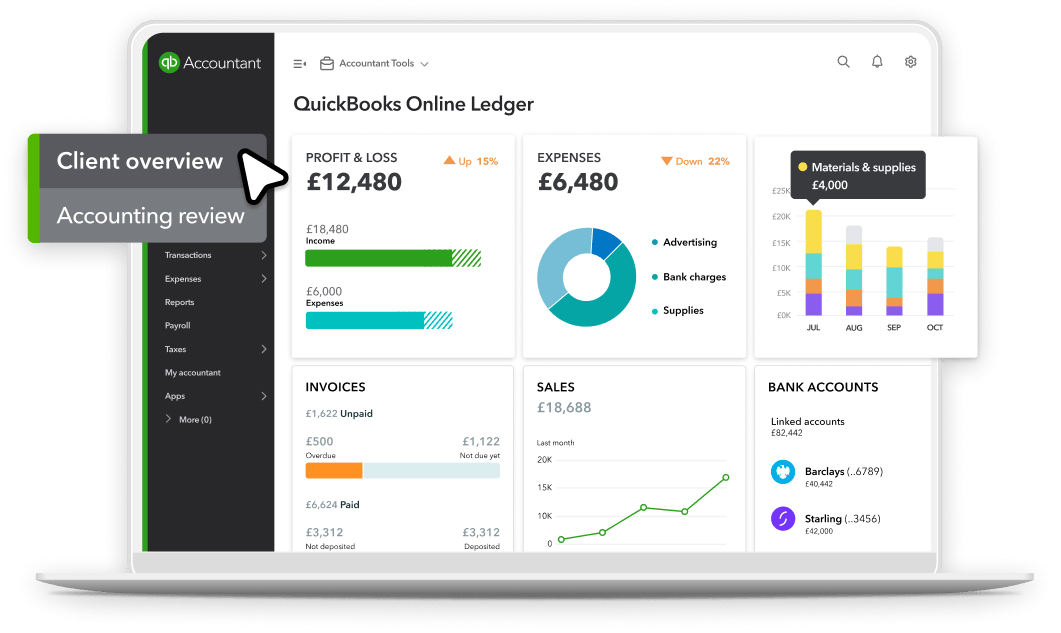

A low-cost solution for your ledger clients

Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support page

MTD-READY CLIENTS

Making Tax Digital for accountants

Accountants and bookkeepers, simplify compliance for your clients with QuickBooks. Get more done in less time with our MTD for IT (Income Tax) functionality and AI automation, all in one place on the Intuit platform.

Access powerful MTD-ready accounting and payroll software for up to 60% off when you manage the subscription billing for your clients.

Be MTD for Income Tax ready with QuickBooks

QuickBooks is the #1 recommended cloud accounting software.1 See how our HMRC-recognised, MTD-ready solutions can support your practice and clients.

Get discounted QuickBooks subscriptions for your clients

Save 50% on QuickBooks Online when you manage the subscription billing for your clients.

Talk to us about your client needs

Our product experts are here to answer your questions and help you choose the right plan(s) for your clients.

0808 168 4296

9.00am - 5.30pm Monday - Friday or request a callback

Talk to us about licence package options and payroll discounts on 0808 258 4342.

Start using QuickBooks Online Accountant

Manage your practice and clients all in one place. Create your free account today.

Or give us a call for a FREE consultation:

0808 168 4296

9.00am - 5.30pm Monday - Thursday, 9.00am - 4.30pm Friday or request a callback

"We have a good relationship with the QuickBooks technical and MTD product team. I can provide feedback that contributes to the system's development."

David Branagan, Branagans Accountancy Services

Get expert help from real people

You'll get real human support 7 days a week with us.**

Compare and switch

Want more from your accounting software? See how QuickBooks compares to your current solution and how easy it is to switch your practice and clients to us.

We'll get your clients up and running

New to QuickBooks? Book a free 45-minute onboarding session with one of our product experts. They'll walk you through key features and answer your questions—your welcome email has all the details.

Talk to a real person

Our award-winning UK-based experts are here for you and your clients 7 days a week** with free support via phone, live chat and screen sharing.

Timeline for Making Tax Digital

QuickBooks has been helping accountants, bookkeepers and their clients to prepare for Making Tax Digital since 2018. Here are the key dates for compliance.

April 2024 and April 2025

The private beta testing phase for MTD for Income Tax launched in 2024, with the second public beta phase in April 2025.

April 2026

Making Tax Digital for Income Tax applies to self-employed individuals and landlords with a total qualifying income that exceeds £50,000 from these income sources for a tax year.

April 2027

Making Tax Digital for Income Tax applies to self-employed individuals and landlords with a total qualifying income that exceeds £30,000 from these income sources for a tax year.

April 2028

Making Tax Digital for Income Tax applies to self-employed individuals and landlords with a total qualifying income that exceeds £20,000 from these income sources for a tax year.

MTD resources for accountants

A win-win for businesses and the accounting sector

Find out about the benefits of MTD for ITSA for the industry, HMRC and businesses. Rebecca Benneyworth discusses the benefits of digital record-keeping and real-time access to taxpayer information, the positive impact on talent acquisition and the environment.

Digitalisation will create more resilient businesses

What happens when digitalisation and financial visibility come together? Hear from Eriona on how MTD for Income Tax will allow businesses to take the right actions at the right time.

Ahead of the curve: MTD beta pilot

Hear from David Branagan about the QuickBooks MTD for ITSA beta pilot program. The pilot enables participants to provide input into the system being developed and helps them prepare their clients for the upcoming mandate.

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.